On March 28, Apple Inc. appeared in court in Shanghai to defend charges that Siri, its voice-recognition, personal-assistant software, allegedly infringes a Chinese patent. The plaintiff and owner of the patent, Zhizhen Internet Technology Co., claims its version of the software has over 100 million users in China and is requesting the court to ban all manufacturing or sales of Apple’s product in China.

This was not the first time Apple faced patent infringement claims in China. Last summer a Taiwanese man sued the company in China for alleged infringement relating to its Facetime technology; in 2010 a Shenzhen company threatened to sue concerning iPad design; in 2008 Apple was sued for the iPod; and in 2012, a Hong Kong company launched GooPhone I5, an android-based replica of the iPhone 5, reportedly based on leaked photos of the iPhone. GooPhone claimed to have patented the design and threatened to sue Apple if it dared to sell the genuine article in China.

Nor is Apple alone. French company, Schneider Electric lost a $48 million patent infringement verdict in China and Samsung lost one for $7.4 million. Sony, Phillips, Canon and Dell have all had their battles and GooPhone sells knockoffs of other smartphones in China with apparent impunity. Of course it’s possible in some cases the Chinese technology may be first and the Chinese patent legitimate. However, foreign companies face a growing risk that Chinese entities may unscrupulously patent foreign technology in China and demand a toll to do business there. Not only that, but in coming years companies will increasingly face challenges worldwide from the growing landslide of patents coming out of China.

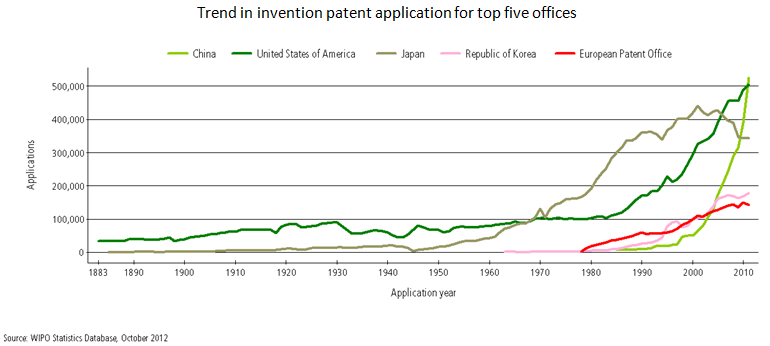

It has been less than three decades since China adopted its first modern patent law (bear in mind that lawyers, scientists and engineers were denounced during the Cultural Revolution), but the number of patents granted to Chinese inventors, in China and worldwide, has been growing exponentially and the consequences will be profound. While Chinese patents are often criticized as lacking in quality, and there may be some truth to that, it misses the greater point – that sometimes lack of quality is more than compensated by sheer volume.

In 2012, China’s State Intellectual Property Office (SIPO) granted more patents than any other patent office in the world, including the U.S. Patent and Trademark Office (USPTO). Those 1.26 million Chinese patents represented a 31% increase over the number granted in 2011. But that’s just the beginning. China’s government has set a goal of granting 2 million patents per year by 2015, something former USPTO Director David Kappos called “mind blowing,” but a target many believe is realistic. Moreover, almost 80% of China’s patents were awarded to domestic applicants in 2012, while fewer than 50% of all U.S. patents went to U.S. citizens.

Internationally in 2012, Chinese inventors filed 18,627 applications under the Patent Cooperation Treaty (PCT), just 228 applications fewer than third-place Germany, behind the U.S. and Japan. At the USPTO in 2012, Chinese inventors filed fewer patent applications than eight other nations (U.S., Japan, Germany, South Korea, Taiwan, Canada, U.K. and France), but their applications increased by 41% over the prior year, more than twice the rate of increase of any of those other countries and 2012 marked the first year a Chinese company entered the rankings of the top 50 U.S. patent recipients (Hong Fu Jin Precision Industry Corp., at #40, with 782 U.S. patents granted). Over the past decade, U.S. patent applications from Chinese inventors have increased more than 1,000%.

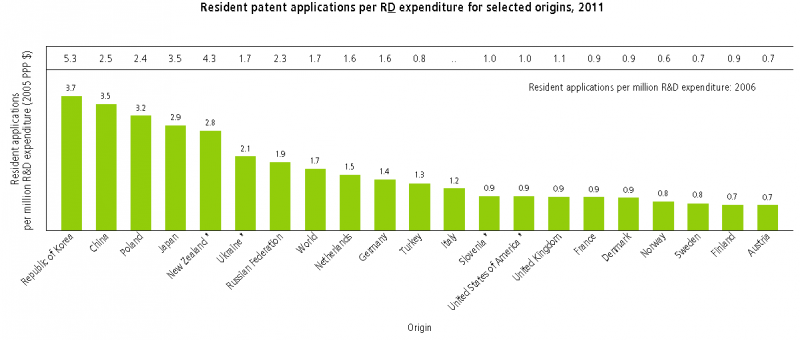

The explosion in Chinese patent applications results partly from the nation’s emphasis on R&D. China’s telecom giant, Huawei Corporation, increased R&D spending by more than 25% in 2012, to $4.7 billion, and holds more than 50,000 patents worldwide. China’s other telecom giant, ZTE Corp, invested $1.4 billion in R&D in 2012 and led the world in PCT filings for the second straight year, with more than 3,900 applications (32% more than second-place Panasonic). Overall, China spends almost $300 billion on R&D, second only to the U.S., with one recent study predicting R&D spending in China will exceed that of the U.S. by 2023.

Additionally, China, Japan and Korea are more efficient at converting R&D dollars into patents than U.S. or European countries. According to the World Intellectual Property Organization (WIPO), for every million dollars spent on R&D, Korean entities apply for 3.7 patents, Chinese 3.5 patents, Japanese 2.9 patents and Americans just 0.9 patents.

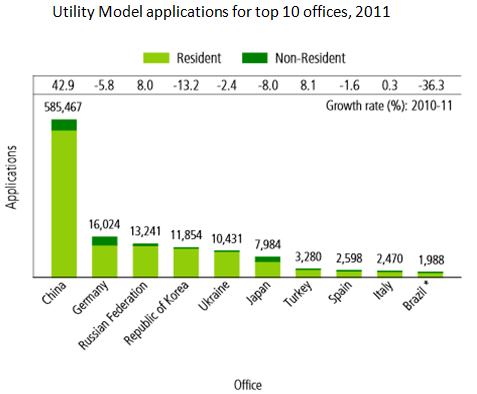

For China, the difference may be largely due to government incentives, such as financial remuneration, tax breaks and other benefits offered by the government in exchange for the filing of patents, domestically and internationally, which causes applicants to focus on patent quantity rather than quality. In support of that argument, critics point at the abundance of Utility Model (UM) patents in China. UM patents, also known as “petty patents,” are widely perceived as being inferior to true invention patents, though that characterization may not be completely fair.

While UM patents are not available in the U.S. or U.K., they exist in more than 50 countries, including France, Germany, Japan, Korea and Taiwan. UM patents are essentially the same as invention patents, but have a shorter term and less stringent patentability requirements, making them cheaper and faster to obtain and more suitable for inventions with a short commercial life. In China, UM patents protect only new shapes or structural features, have a term of 10 years (compared to 20 years for invention patents) and no substantive examination is required (only a brief formality exam). They are typically granted in about a year.

However, China’s UM patents are controversial because they are so abundant. According to WIPO statistics, China’s patent office received 585,467 applications for UM patents in 2011 – more than 30 times the number received by any other patent office. Second place Germany received just 16,024 UM applications. Not only that, but the vast majority of all UM patents in China are granted to domestic applicants.

Perhaps because they are unfamiliar with UM patents, or because they feel they lack value, U.S. and other foreign entities seek far fewer UM patents in China than locals do. Of the three types of patents available in China, in 2011 Chinese entities applied for 26% invention, 39% UM and 35% design patents, while U.S. entities applied for 89% invention, 3% UM and 8% design. Foreigners may look down their noses at China’s UM patents, deriding them as poor quality, due to their lower inventiveness standard and lack of substantive examination, but that attitude could land them in trouble.

For example, the Schneider Electric case involved a UM patent. Schneider was a French manufacturer of electrical power equipment and Chint was a multi-billion dollar competitor, based in Wenzhou, China. Schneider filed several patent lawsuits against Chint in Europe, so Chint responded with an infringement action in Wenzhou, seeking statutory damages amounting to less than $75,000. Schneider requested SIPO to invalidate Chint’s patent, but the request was denied and upheld on appeal. Chint then increased its damage request to $48.5 million, based on new evidence of Schneider’s sales revenue. The Wenzhou court found in favor of Chint, awarding a judgment for the full $48.5 million. Finally, after two years of appeals, the parties entered a global settlement in 2009 for $23 million.

The Schneider case was a milestone in China patent litigation. It remains China’s largest patent verdict to date and helped raise awareness, locally and internationally, of the potential value of Chinese patents. Admittedly, damage awards in China are usually much smaller than in the U.S. If a patent owner cannot prove lost profits, wrongful gains or reasonable royalties, related to the infringement, it must settle for statutory damages that are capped at RMB 1 million (about US$160,000). Because China lacks formal discovery procedures, that is the usual outcome. Enhanced damages for willful infringement are also unavailable in China, so multi-million dollar judgments are rare.

However, China’s government is presently considering potential revisions to the Patent Law, including adding possible treble damages for willful infringement. And in the Proview case, just last year, a Shenzhen company sued Apple in China for trademark infringement relating to use of the iPad mark and forced Apple to pay $60 million to settle the dispute. While that case involved a trademark, not a patent, it may be indicative of a broader trend. Many have noted that nations (including the U.S., Germany and Japan) tend to be indifferent to the protection of intellectual property rights when the nation is in an early stage of developing innovation and technology, because at that point its citizens benefit from pirating from others; but as the nation develops, it tends to become more protective of IPR, because its citizens have property to protect. That may be the case in China.

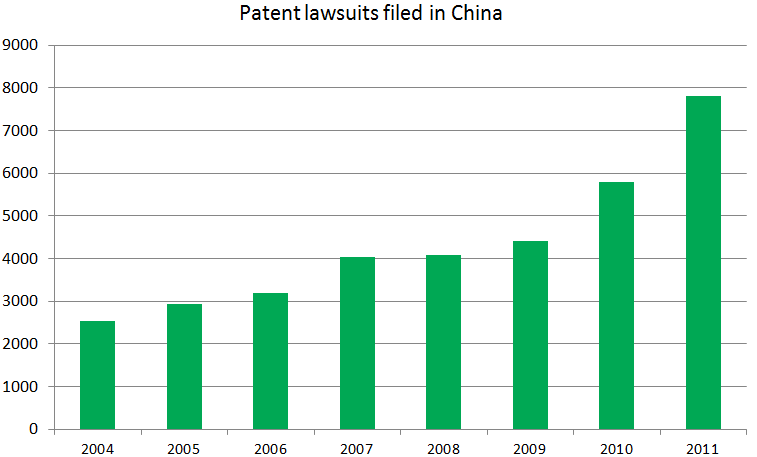

In any event, despite the smaller judgments, far more patent lawsuits are filed in China than the U.S. In 2011, 7,819 patent suits were filed in China, compared to 4,015 in the U.S. Admittedly, fewer than 5% of all lawsuits in China involve intellectual property and foreigners are involved in fewer than 5% of those cases. (China IPR blog counted 1,296 intellectual property cases filed in 2011 involving foreigners compared to more than 8,000 maritime cases involving foreigners.) However, those statistics provide little comfort to the foreign defendant.

Not only are patent lawsuits plentiful in China, but they’re fast, often taking just six months from filing of the Complaint to trial and another three months for appeal, compared to several years in the U.S. That may be part of the reason why more than 70% of all Chinese patent lawsuits go all the way to trial, without being settled or dismissed, compared to fewer than 10% in the U.S. And, with no formal discovery procedures for a defendant to investigate the charges, defendants in China tend to be at a huge disadvantage, especially when the Chinese plaintiff filed the action in its home province.

Chinese companies are also starting to file patent lawsuits in other countries. In 2006, Shenzhen’s Netac Technology sued a U.S. company in Texas for infringing a patent relating to USB flash memory drives. Three years later, a Changzhou company sued Wal-Mart, Best-Buy and several other retailers for selling products that infringed its U.S. patents relating to GPS devices. Lenovo Group, China’s biggest computer maker, has filed actions concerning patents it obtained when it acquired IBM’s PC division. Huawei sued Motorola and Nokia Siemens Networks in the U.S. And ZTE and Huawei have filed patent lawsuits in Germany, France, Hungary and China.

Of course, the U.S. remains the most important venue for patent litigation and Americans still hold vastly more U.S. patents than Chinese applicants do (in 2011, U.S. entities applied for 247,750 U.S. invention patents, compared to just 10,545 for Chinese applicants), but the global patent landscape is rapidly changing and China is increasingly becoming more relevant.

In particular for the foreign company that wishes to manufacture in China or sell in China’s giant, growing market, it would be foolish to disregard the potential threats posed by China’s home-grown patents. The foreign entrant should perform a careful freedom to operate analysis before commencing business, recognize the need to play by local rules, and strongly consider building its own portfolio of Chinese patents – including UM patents – to be prepared for the inevitable.

I found your blog very useful and correct, thanks for sharing detailed info here!

Thanks. 🙂